| WISCONSIN – The Small Business Administration (SBA) 504 Program is a powerful tool for businesses that want attractive financing for building purchases, new construction, refinancing, and equipment. |  |

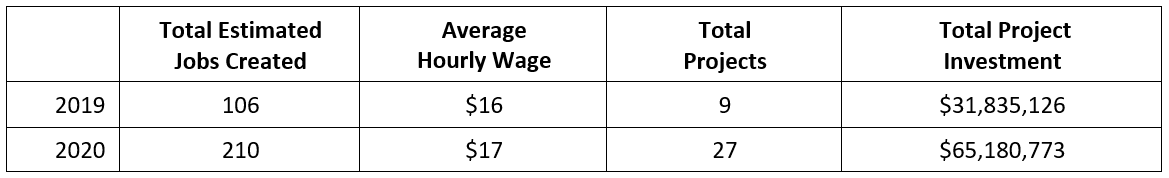

| Because of the uncertainty the pandemic caused, an increased number of businesses sought out the SBA 504 program to enjoy the long-term fixed interest rates. As a result, Business Lending Partners (BLP), the financing specialty area at the Racine County Economic Development Corporation (RCEDC), saw an influx of SBA 504 loans approved in 2020. |

|

| “I truly believe in the SBA 504 product,” said Robert Pieroni, VP of Commercial Banking at Community State Bank. “The expedited process, the long-term, low interest rates, and the BLP team that works hard to get these loans approved – all these factors create an unparalleled financial solution for expanding Wisconsin businesses.” |