- Massachusetts takes the top spot as the U.S. state with the highest chance of survival over three years for a small business.

- Wisconsin comes in second.

- South Dakota is revealed as the third-best state for a small business to survive at least three years.

Capital on Tap, a business credit card expert, has conducted new research to determine the U.S. states with the highest chance of survival for a small business in a three-year and five-year time frame.

The study analyzed data from the U.S. Bureau of Labor Statistics to reveal the percentage of start-ups that are still active after three years. For a company that opened in 2019, the survival rate is determined in 2021.

Massachusetts – Small business 3-year survival rate: 64.96%

Massachusetts has emerged as the U.S. state with the highest chance of survival for a small business. Out of the number of small businesses that opened in 2019 in Massachusetts, 64.96% have survived over three years. This survival rate is 19% higher than Washington, which places last in the ranking, with just 54.6% of small businesses still running after three years.

Wisconsin – Small business 3-year survival rate: 64.93%

Wisconsin has the second highest chance of a small business surviving at 64.93% on a three-year average. Starting your own business can be a considerable risk, but in this state, the chance of survival after three years of opening is nearly five percentage points higher than the national average of 60.27% as well as being almost six percentage points higher than the national average for a five-year survival rate (49.21%).

South Dakota – Small business 3-year survival rate: 64.03%

In third position is South Dakota, with 64.03% of small businesses being active three years after their opening in 2019. Small business owners in this area also have the third highest chance of their small business surviving five years after opening.

Minnesota- Small business 3-year survival rate: 63.97%

Minnesota places fourth compared to all U.S. states, with a small business survival rate of 63.97% three years after opening. After five years, in Minnesota, 53.51% of companies are still active.

Iowa– Small business 3-year survival rate: 63.71%

63.71% of businesses opened in 2019 in Iowa survived for at least three years. Iowa’s strongest years for three-year business survival were for businesses that opened in 2000, 2008, and 2009.

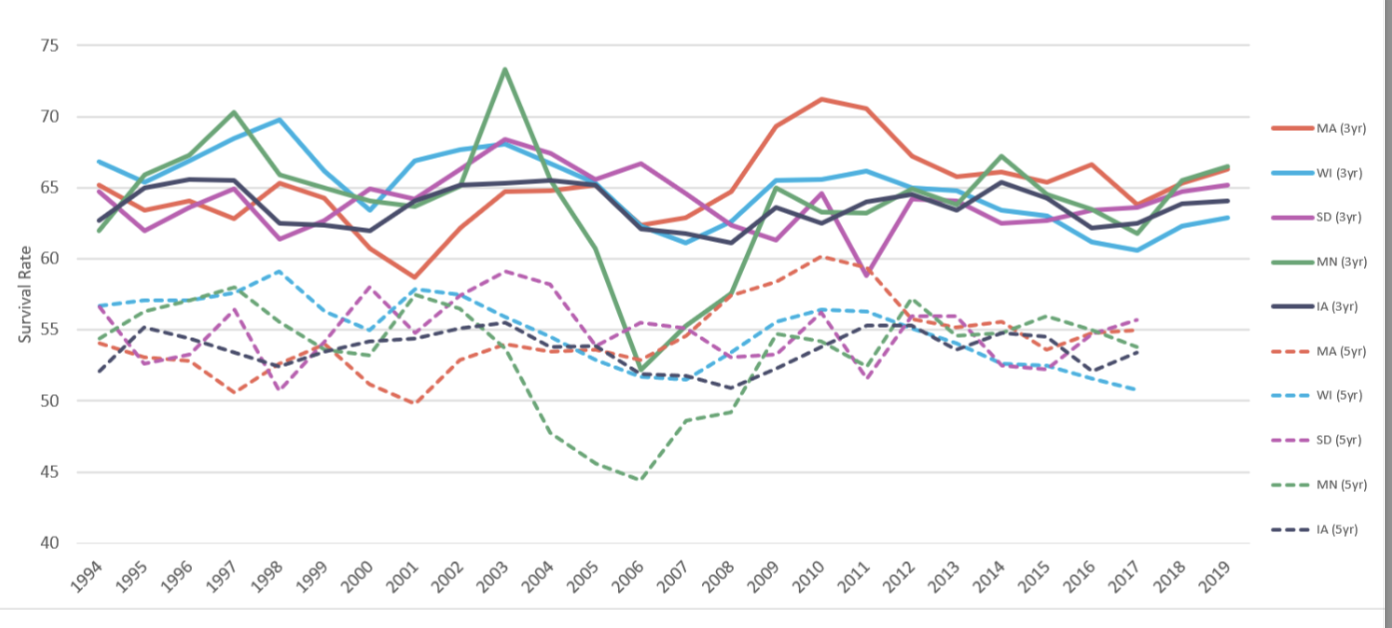

The top five ranking U.S. states average five-year survival rate.

The top ten is made up of:

6. North Dakota- Small business 3-year survival rate: 63.63%

7. Pennsylvania – Small business 3-year survival rate: 63.51%

8. Montana – Small business 3-year survival rate: 62.79%

9. Hawaii – Small business 3-year survival rate: 62.22%

10. North Carolina – Small business 3-year survival rate: 61.91%

| Top Ten U.S. states with the highest rate of small business survival. | |||

| State | 1year average (%) | 3year average (%) | 5year average (%) |

| Massachusetts | 81.91 | 64.96 | 54.38 |

| Wisconsin | 81.13 | 64.93 | 54.97 |

| South Dakota | 80.44 | 64.03 | 54.88 |

| Minnesota | 80.96 | 63.97 | 53.51 |

| Iowa | 80.85 | 63.71 | 53.65 |

| North Dakota | 79.55 | 63.63 | 53.98 |

| Pennsylvania | 80.69 | 63.51 | 53.18 |

| Montana | 79.60 | 62.79 | 53.03 |

| Hawaii | 79.37 | 62.22 | 52.21 |

| North Carolina | 79.85 | 61.91 | 51.25 |

| Bottom Ten U.S. states with the lowest rate of small business survival. | |||

| State | 1year average (%) | 3year average (%) | 5year average (%) |

| Washington | 75.12 | 54.60 | 42.75 |

| District of Columbia | 76.04 | 54.73 | 43.73 |

| New Mexico | 76.64 | 56.58 | 45.58 |

| Florida | 77.00 | 56.82 | 44.95 |

| Nevada | 77.18 | 57.38 | 46.79 |

| New Hampshire | 76.65 | 57.52 | 46.63 |

| Arizona | 77.34 | 58.00 | 46.74 |

| Tennessee | 78.46 | 58.21 | 46.81 |

| Arkansas | 77.64 | 58.24 | 47.25 |

| Rhode Island | 76.76 | 58.30 | 47.75 |

Damian Brychcy, Chief Legal, America and Product Officer at Capital on Tap, said: “Despite the gruelling statistic that 20% of American small businesses fail within their first year, it’s reassuring to see that many states offer a strong environment for businesses to grow.

There are over 30 million small businesses in the U.S., making up an enormous percentage of the economy, and as this number continues to grow, so will innovation and commercial drive. This research should serve as a positive sign to entrepreneurs in the top ten states who are thinking about starting a business.”

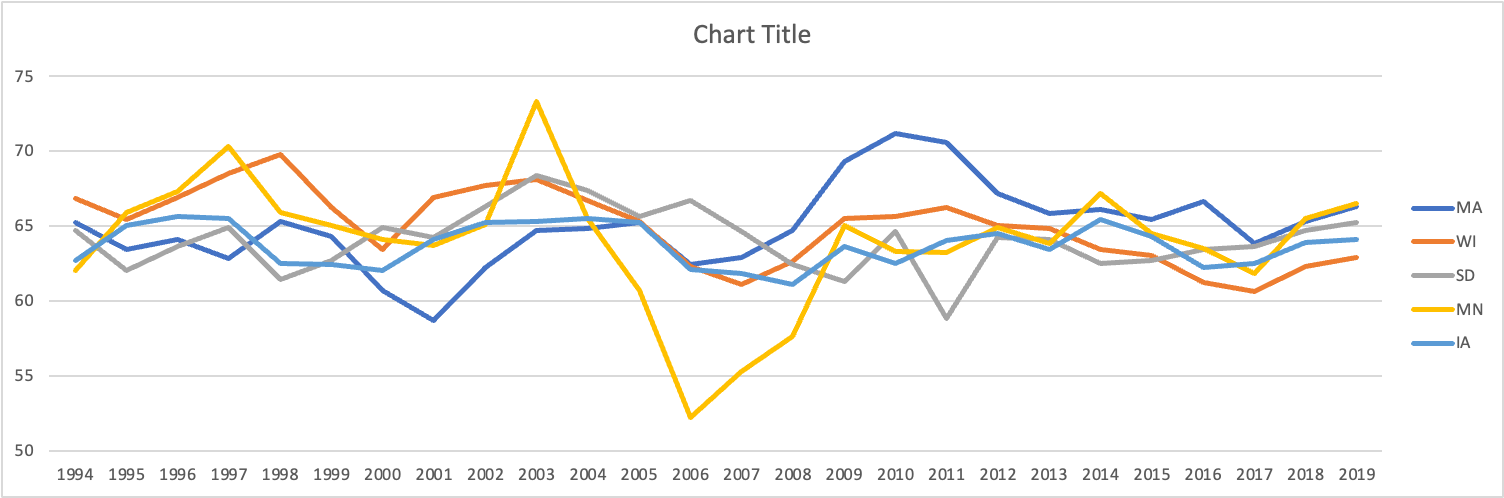

Survival rate for the top five ranking U.S. states across three and five years.

Ends

Source: bls.gov/bdm/al_age_total_table7.txt

Methodology: The survival rate of private sector establishments by opening year was scraped from BLS for each U.S. state between 1994 and 2022. When looking at the one-year survival rate of a business that opened in 1994, for example, the survival rate was taken for 1995. When looking at the three-year survival rate of a business that opened in 1994, data was taken from 1997.

If using this story, please link credit to: https://www.capitalontap.com/us/business-credit-cards/

About Capital on Tap

Globally, Capital on Tap provides an all-in-one small business credit card and spend management platform. Access funding for your business, manage cards for your employees, and earn best-in-class rewards – all built with small business owners in mind. In the US the Capital on Tap Business Credit Card is issued by WebBank.